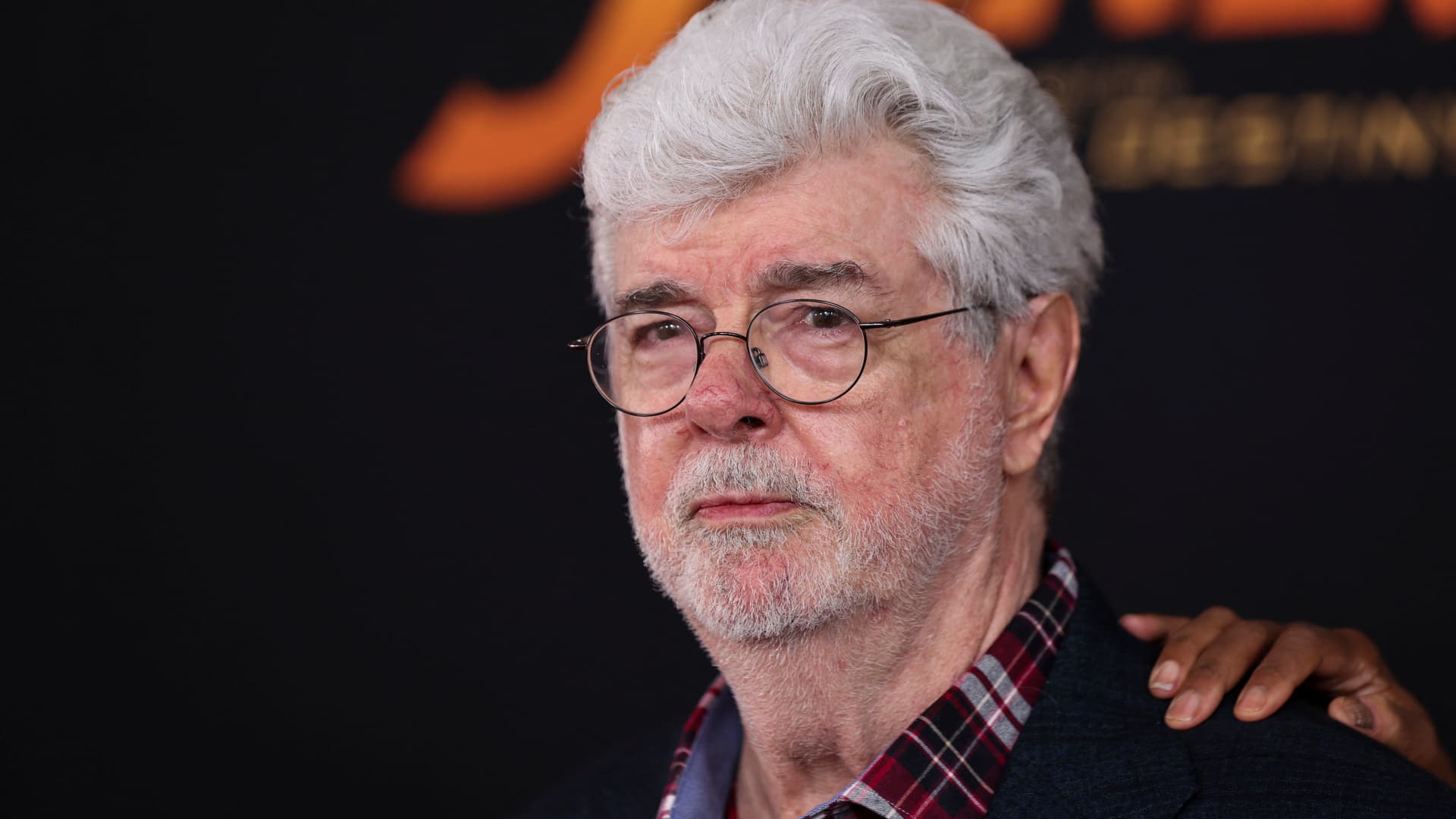

Filmmaker and Hollywood legend George Lucas is throwing his support behind Walt Disney CEO Bob Iger in the bitter proxy battle between the company and activist investor Nelson Peltz.

Lucas, who received 37.1 million Disney shares as part of Disney’s $4.05 billion purchase of Lucasfilm in 2012, is currently the largest individual investor in the company, multiple sources confirmed to CNBC.

In a statement provided to CNBC, Lucas wrote:

“Creating magic is not for amateurs. When I sold Lucasfilm just over a decade ago, I was delighted to become a Disney shareholder because of my long-time admiration for its iconic brand and Bob Iger’s leadership. When Bob recently returned to the company during a difficult time, I was relieved. No one knows Disney better. I remain a significant shareholder because I have full faith and confidence in the power of Disney and Bob’s track record of driving long-term value. I have voted all of my shares for Disney’s 12 directors and urge other shareholders to do the same.”

Disney has lined up a number of high-profile endorsements in its battle against Peltz and his firm, Trian Fund Management, from the heirs of Walt and Roy Disney to JPMorgan Chase CEO Jamie Dimon.

But the support from the Lucas endorsement is key, not only because of his role as Disney’s largest individual shareholder, but also because of his standing in Hollywood. Lucas wrote and created the “Star Wars” and “Indiana Jones” franchises, some of the most popular films in history, and he helped pioneer tools such as digital film editing and computer-generated imagery.

Peltz has asked investors to nominate him and former Disney Chief Financial Officer Jay Rasulo to the board at its annual general meeting on April 3. Among other things, Peltz wants to overhaul Disney’s traditional TV channels, which he thinks have been a shrinking business.

Iger, meanwhile, has been trying to streamline the sprawling media company to rein in spending and make its Disney+ streaming platform profitable. Iger has instituted broad restructuring, including thousands of layoffs.