Oliver Furrer | Cultura | Getty Images

You don’t have to be a hedge fund guru to discuss alternative investments with your clients, yet it doesn’t hurt to get educated.

It’s no secret that portfolio diversification protects investors from the whims of the stock market, blunting the volatility you get in equities by including an allocation toward fixed income.

Unfortunately, bonds and equities don’t always move in different directions.

Investors in target-date retirement funds learned that the hard way in 2008, when some portfolios held risky high-yield bonds in their fixed income allocations and experienced massive losses.

That’s where alternative investments — primarily liquid alternatives — enter the mix.

“The primary role of liquid alternatives in a portfolio is to provide an opportunity to diversify away from traditional equity and fixed income,” said Shana Sissel, senior portfolio manager at CLS investments in Omaha, Nebraska.

Liquid alternatives offer hedge fund-like strategies to retail investors in a mutual fund.

Those strategies include market neutral, which hold both long and short positions in stocks, and managed futures, which hold long and short positions in different futures.

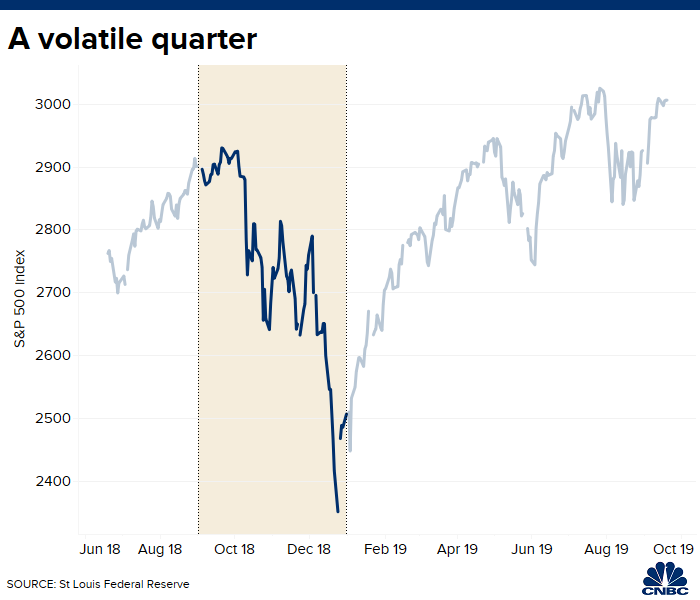

Consider that while the Standard & Poor’s 500 index was down 13.52% in the fourth quarter of 2018 — a volatile period last year — mutual funds that used a market neutral strategy were down by an average of 0.41%, according to Morningstar.

However, there’s a cost to that result: These funds have expense ratios that can exceed 1% — and in some cases, they’re more than 2%.

It’s not a playground for do-it-yourselfers.

“For retail investors, it’s easy: Just don’t do it,” said Jason Kephart, associate director of the multi-asset and alternatives strategies team at Morningstar.

Advisors curious about these funds also need to consider the client’s goals and ask some difficult questions.

“The advisor has to ask, ‘What do you want from this fund? If this is a 60/40 portfolio, are you dampening equity risk? Are you worried about interest rates rising?'” Kephart said.

Here’s where to start.

Know your purpose

“When we think about liquid alternatives, we classify them into two camps: return enhancers and diversifiers,” said David Lebovitz, a global market strategist for J.P. Morgan Asset Management’s global market insights strategy team.

Absolute return — a strategy that aims for positive returns regardless of the broader market — tends to fall under the enhancer category.

Meanwhile, managed futures funds and market neutral funds attempt to be uncorrelated with the stock market, which can help diversify a client’s portfolio.

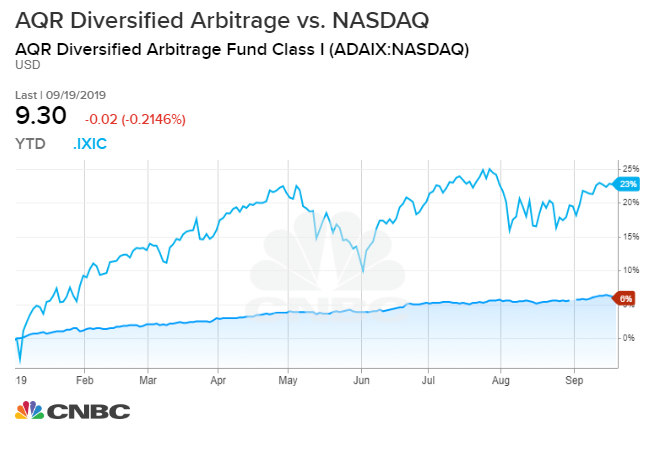

Take the AQR Diversified Arbitrage fund (ADAIX), which declined by 1.8% during the fourth quarter of 2018. In that same period, the NASDAQ, where it’s listed, fell by 17.54%.

Things have changed since then. Year to date, the index is up by 23%, while the fund is up 6%.

It can be difficult for advisors to get this point across to clients — particularly if the fund shielded them during a rocky period in the market.

Weekly advice on managing your money

Get this delivered to your inbox, and more info about about our products and services.

By signing up for newsletters, you are agreeing to our Terms of Use and Privacy Policy.

“Periods like the fourth quarter of 2018 are rare, so the rest of the time you’re wondering why you’re owning this fund that struggles,” Kephart said.

“It’s tough because ‘uncorrelated’ means that the performance drivers aren’t intuitive.”

Understand liquidity costs

Picture Alliance | Getty Images

While these funds are required to be mostly liquid, their managers may still have holdings in illiquid investments to improve returns.

“The nature of these strategies is that the ones that have good performance probably have some measure of illiquidity in them,” Sissel said. “That’s part of what makes the alpha more attractive.”

As mutual funds, liquid alternatives are subject to rules on liquidity and leverage: They must keep at least 85% of their portfolios in liquid assets, and they’re limited to using no more than 33% of the gross asset value of the fund for leverage.

Advisors should still drill into the details on how fund managers are using leverage and what will happen to investors if the fund has problems with its liquidity.

Find the right allocation

Gopixa | Getty Images

How you integrate these investments into a client’s portfolio will differ from one case to the next, yet many experts agree advisors need meaningful exposure — an allocation of 10% to 20% — to make a difference.

“It won’t move the needle at 1% or 2%,” Lebovitz said. “You want it to have a direct impact on the overall pool of assets.”

The investor’s time horizon also plays a role in determining whether these funds have a place in their portfolio.

An investor who’s approaching retirement might be more interested in protecting themselves from market gyrations while a younger investor might have a stronger stomach for risk and higher returns over time.

“When you’re a younger person, you want equity risk when you have a time horizon that’s long,” Kephart said. “Volatility is your friend at that point.”

More from FA Playbook:

Money stress traps women into unhappy marriages

Long-term care insurance costs are way up

These advisors are using social media to grow their business