College student entering a financial aid.

Pamela Joe McFarlane | Getty Images

Students’ knowledge of the financial aid process is “shockingly low.”

That’s the takeaway from a new study by ACT, which in April 2018 surveyed about 1,200 high school students who were registered to take the standardized test.

Regardless of economic background, most families pointed to price as a very important consideration in choosing a college. Yet most students don’t understand the basic workings of financial aid, which includes grants, scholarships, work study and loans.

More than 70% of students didn’t know that loans from the government for undergraduate students are subsidized, meaning interest doesn’t accrue on them while the student is enrolled in college.

Most students also didn’t know that student loans can be repaid on an “income-driven ” plan, in which their monthly payments are capped at a percentage of their income.

Another recent study by the National Center for Education Statistics found that just 11% of ninth graders can correctly estimate the tuition and fees for one year at a public four-year college in their state. Around 57% overestimated the costs, and 32% underestimated them.

“The findings highlight an urgent need for more financial literacy-specific interventions, especially in light of the economic stakes at hand,” said Jim Larimore, chief officer for ACT’s Center for Equity in Learning.

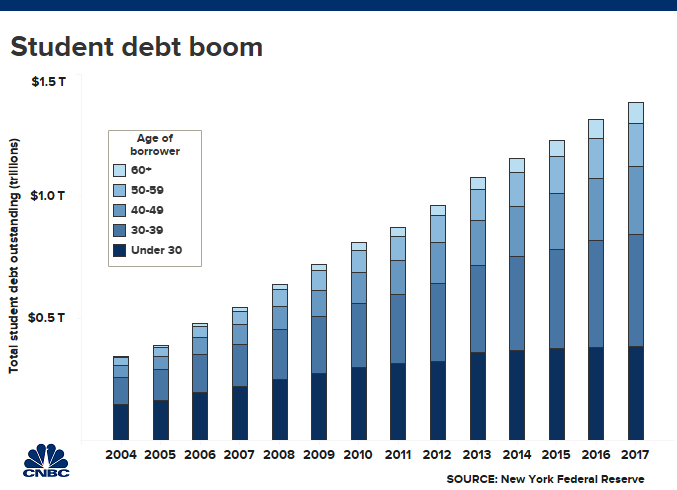

Outstanding education debt in the U.S. is projected to swell to $2 trillion by 2022, eclipsing credit card and auto debt. The average college graduate leaves school $30,000 in the red today, up from $10,000 in the 1990s. And 28% of student loan borrowers are in delinquency or default.

ACT found students were most likely to seek information on the financial aid process through the internet or from their family.

One of the least common sources was a college representative, even though they can often speak best about the details of a particular school’s process and aid availability.

And very few high school students participate in federal college prep outreach programs GEAR UP, Upward Bound and AVID, ACT found.

More from Personal Finance:

A way to get guaranteed income while delaying Social Security

Those credit scores you see may not be what lenders use

Trump vs. the Fed: What it means for your money

The Institute for College Access and Success has a list of tips for navigating the financial aid system, and the Consumer Financial Protection Bureau allows you to compare different colleges’ financial aid packages.

But you won’t get access to any aid unless you fill out the Fafsa, or Free Application for Federal Student Aid.

More than one-third of high school graduates in 2018 didn’t complete the form, personal finance website NerdWallet found, leaving behind $2.6 billion in free college money as a result.

The average person who filed the Fafsa in the 2015-2016 academic year received around $8,500 in federal aid.

“No matter how much your family earns, it’s crucial to fill out the Fafsa,” said Brianna McGurran, NerdWallet’s student finance expert.